Breaking Ground May 2024

If home insurance premiums rose 20% annually for the next 20 years, home prices would fall as much as 10%.

Here are some key details from Realtor.com’s report on homeowners insurance:

- In areas with high sea level risk, there is a $25,000 decline in home values for every $100 rise in insurance premiums

- 30% - 40% of deals in Louisiana fell apart after someone under contract to purchase got an insurance quote.

- About 90% of Florida investors missed out on at least one deal because insurance was either unavailable or unaffordable

- Last month, State Farm said it would discontinue offering coverage for 72,000 houses and apartments in the wildfire-prone state of California beginning in the summer. This comes less than a year after it stopped issuing new home insurance policies in the state.

OUR TAKE:

We are very fortunate that in our markets insurance rates are all much less than the national average. States like Oklahoma, Kansas, Nebraska, Florida, and Colorado have average homeowners insurance rates 4x what it costs in our market. Insurance costs in high risk areas pose a significant threat to homeowners.

Here is how we stack up compared to the US market:

Washington, D.C. - Average rate of $984, $1,021 (51%) less than the national average Maryland - Average rate of $1,318, $687 (34%) less than the national average Virginia - Average rate of $1,645, $360 (18%) less than the national average.

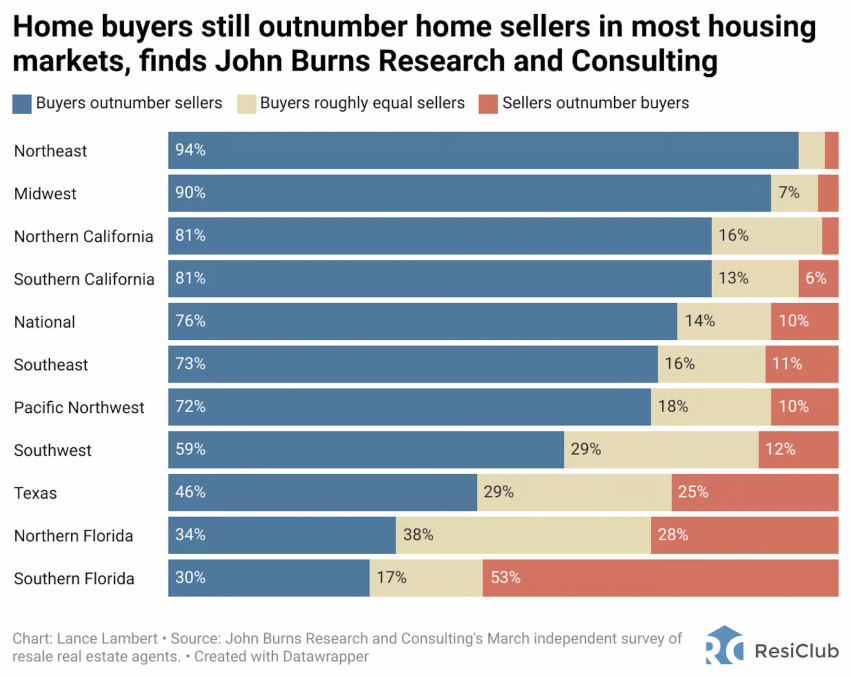

On Thursday, researchers at John Burns Research and Consulting (JBREC) publicly released the results from their March survey of real estate agents.

There’s some softening occurring in pockets of Florida and Texas, where active listings are close to pre-pandemic levels, while there’s still a great deal of competitiveness in tight inventory markets in the Northeast, Midwest, and Southern California.

According to the survey, 94% of resale agents in the Northeast said buyers outnumber sellers in their market. While just 30% of resale agents in Southern Florida said buyers outnumber sellers in their market.

OUR TAKE:

The Northeast Continues to hold strong for the most strong market for real estate across the United States. Why is that? Looking at Montgomery County and Arlington as examples- they have inventory trending about 10% less year over year and 37% less when looking back to 2022. DC inventory year over year is nearly identical. Florida (where people potentially made temporary moves during COVID, or because of rising insurance costs), had the only market where sellers outnumbered buyers.